Table of Contents

- Tax Brackets Head Of Household 2025 - Jackie Emmalyn

- IRS Announces 2025 Tax Brackets, Standard Deductions And Other ...

- 2025 tax brackets: Key changes to know as filing season approaches ...

- The Whitlock Co. | Long-Term Care Expenses: What Can You Deduct?

- The new IRS Tax Brackets of 2025 are near and this is what we can expect

- World Tax 2025 Rankings - Your questions answered

- Tax Brackets Change in 2025. Should My Roth Strategy Change in ...

- IRS announces 2025 tax brackets, increase for standard deduction ...

- Will Tax Relief Be Enacted In 2025 - Stewart Morrison

- IRS Announces 2025 Tax Brackets and Standard Deductions Adjusted for ...

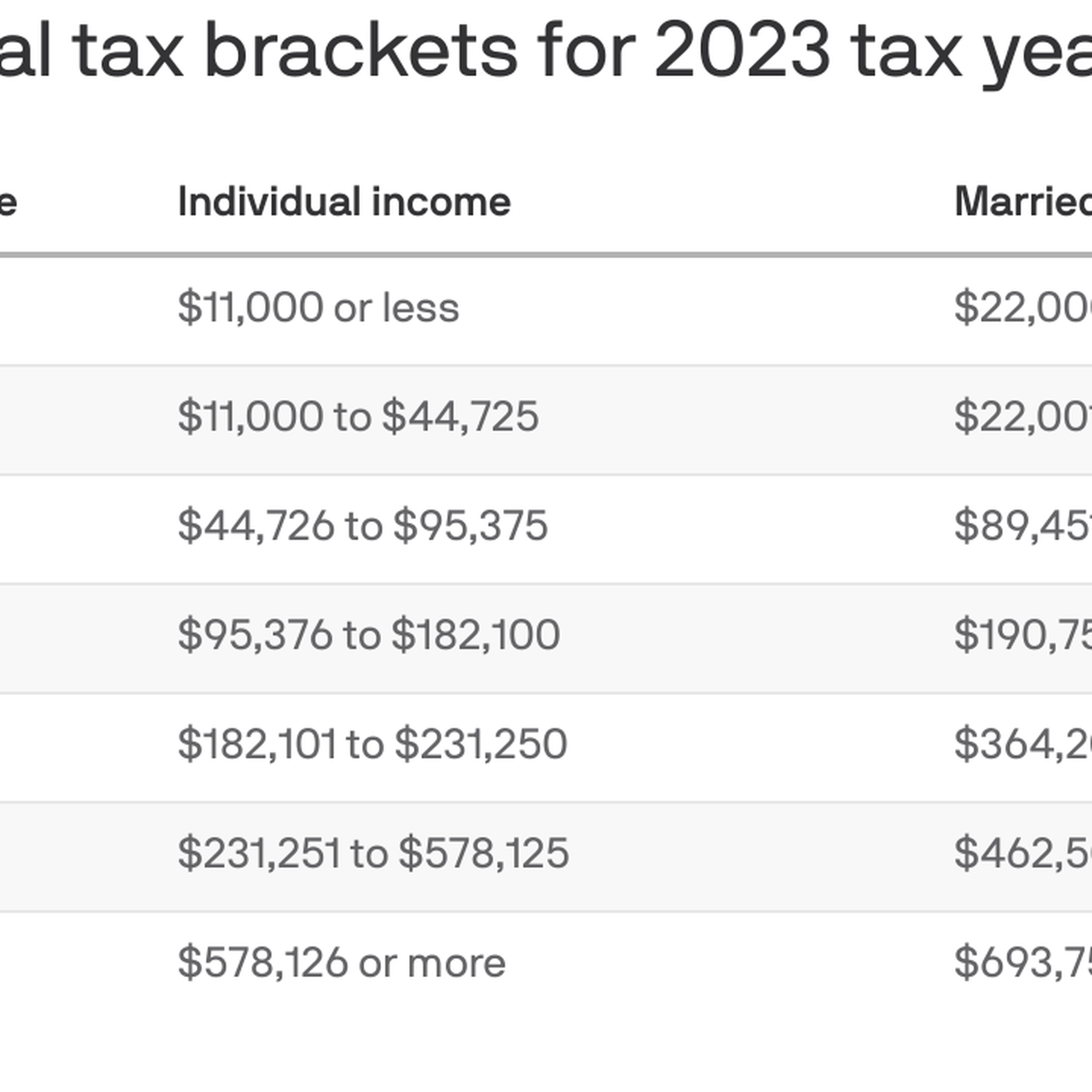

What are the 2025 Federal Income Tax Brackets?

Changes to Tax Deductions and Exemptions

How Will the 2025 Federal Income Tax Brackets Affect You?

The 2025 federal income tax brackets will affect taxpayers in different ways, depending on their income level and tax filing status. Taxpayers with higher incomes will be subject to higher tax rates, while those with lower incomes will be subject to lower tax rates. It's essential to review your tax situation and adjust your withholding or estimated tax payments accordingly. You may also want to consider consulting with a tax professional to ensure you're taking advantage of all the tax deductions and credits available to you. In conclusion, the 2025 federal income tax brackets will bring some significant changes to the tax landscape. By understanding the new tax brackets, deductions, and exemptions, you can better plan your tax strategy and minimize your tax liability. Remember to stay informed and consult with a tax professional if you have any questions or concerns about the 2025 federal income tax brackets.Keyword density: 2025 federal income tax brackets (2.5%), tax rates (1.8%), tax deductions (1.5%), tax exemptions (1.2%)

Meta description: Learn about the 2025 federal income tax brackets, including the new tax rates, deductions, and exemptions. Understand how the changes will affect your tax liability and plan your tax strategy accordingly.

Header tags: H1, H2

Word count: 500 words